Company Creation,

Brand Design,

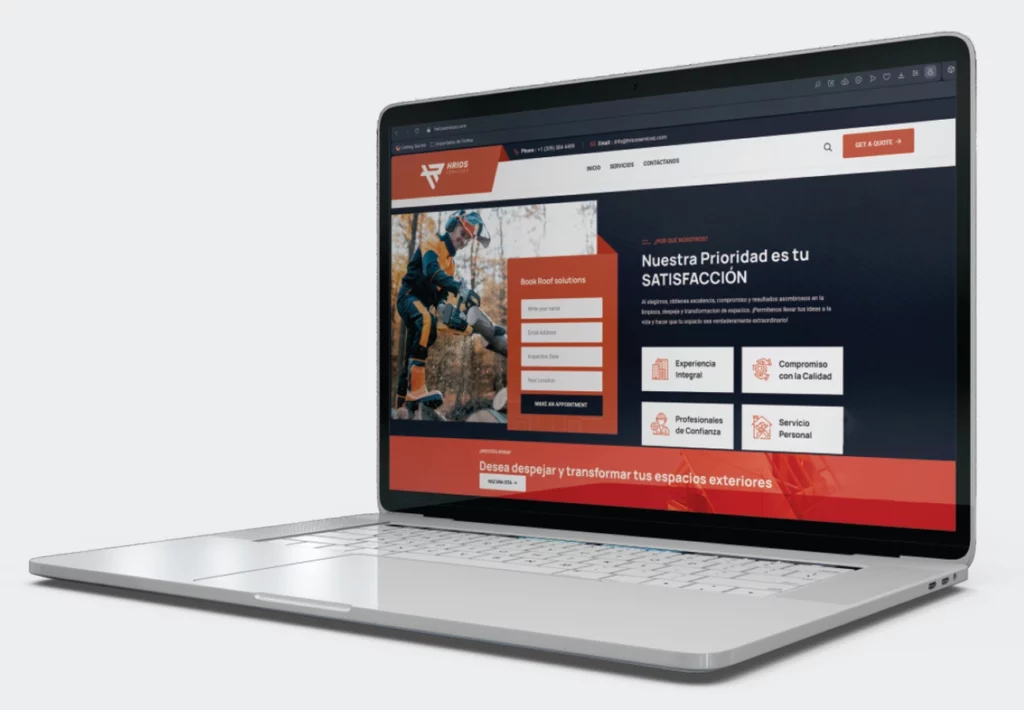

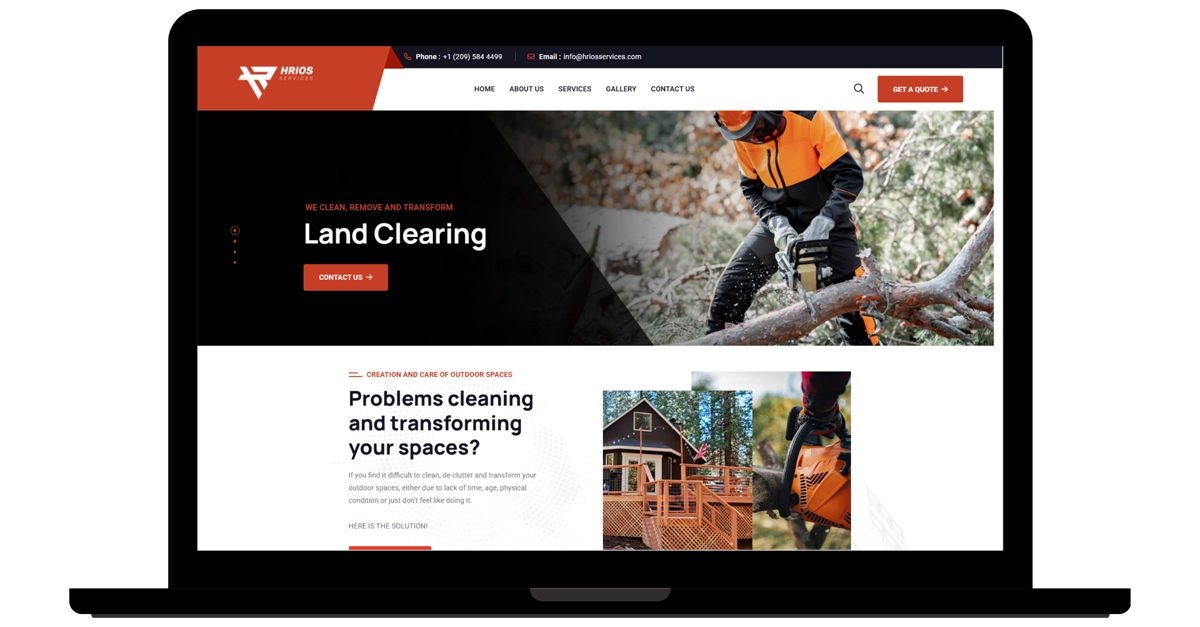

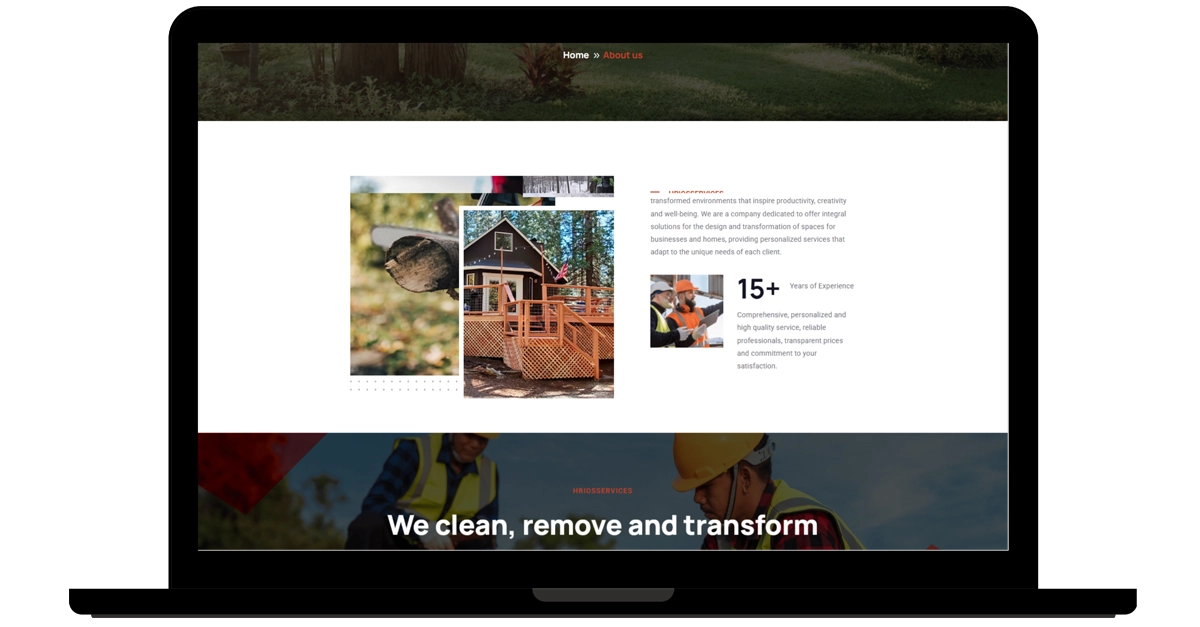

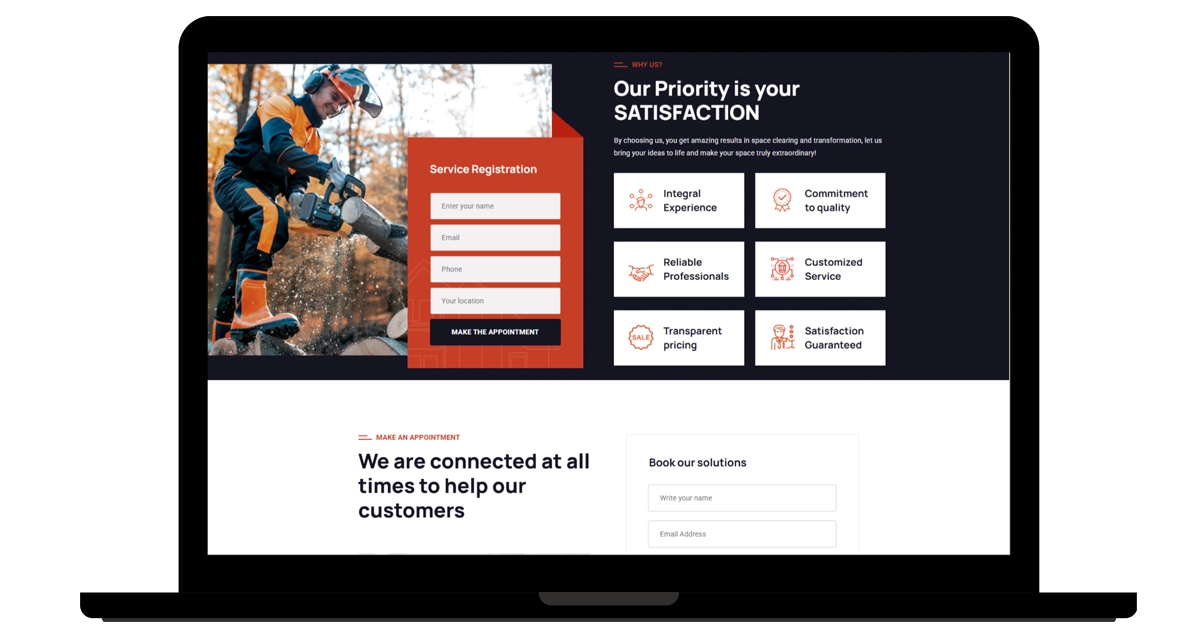

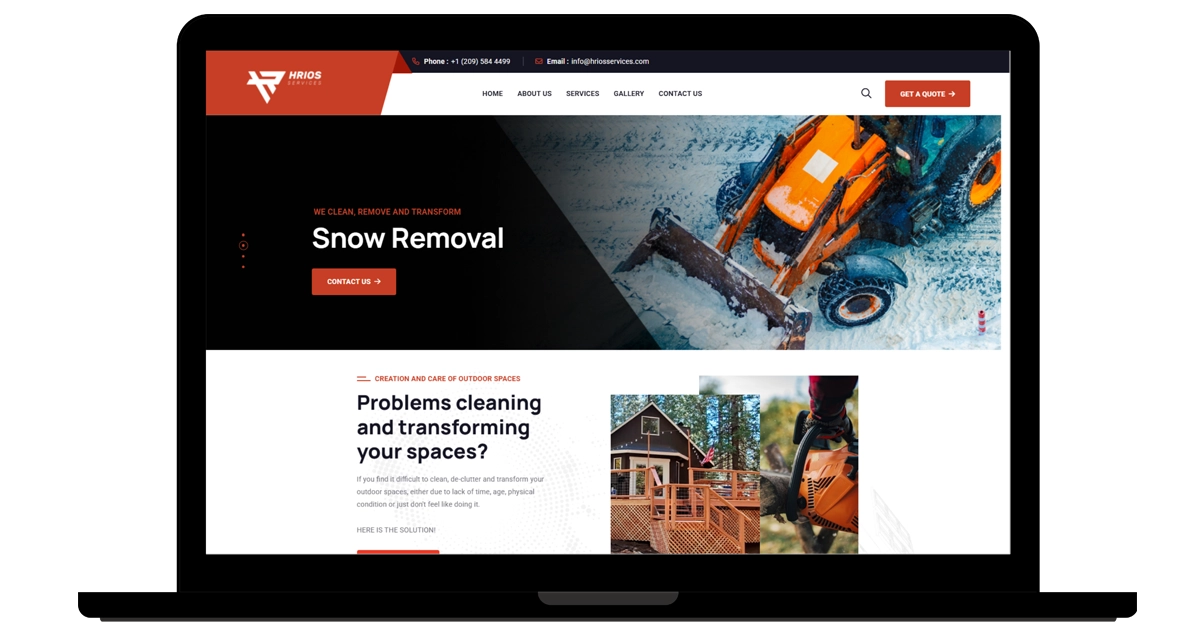

Web Design,

Hosting,

Email Server,

Article Printing.

HRIOS SERVICES INC

Landscaping

Arnold, California

Logo

Typography and Color

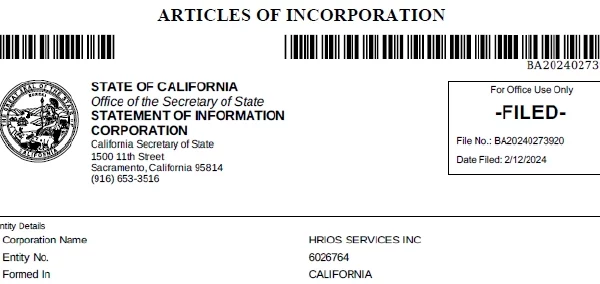

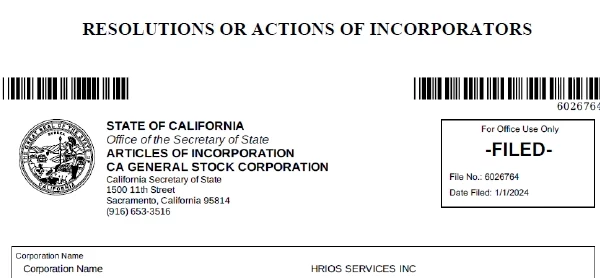

Legal Documents Completed

This document records the initial decisions made by the incorporators or directors during the corporation’s first organizational meeting.

It includes:

- Approval of the bylaws.

- Appointment of the first directors and officers.

- Authorization to issue shares.

- Resolutions to open bank accounts or perform any other essential actions.

This is the primary document filed with the state to legally form the corporation.

It includes:

- Name of the corporation.

- Principal address.

- Purpose of the business.

- Information about the registered agent.

- Number and types of authorized shares.

- Names of the incorporators.

These are decisions made by the incorporators (the individuals responsible for forming the corporation) before the board of directors is established.

They include:

- Appointing the first directors.

- Approving the Articles of Incorporation.

- Other decisions related to setting up the corporation.

The bylaws are the internal rules governing how the corporation is managed.

They include:

- Procedures for board and shareholder meetings.

- Roles and responsibilities of officers and directors.

- Processes for issuing shares.

- Rules for handling corporate records.

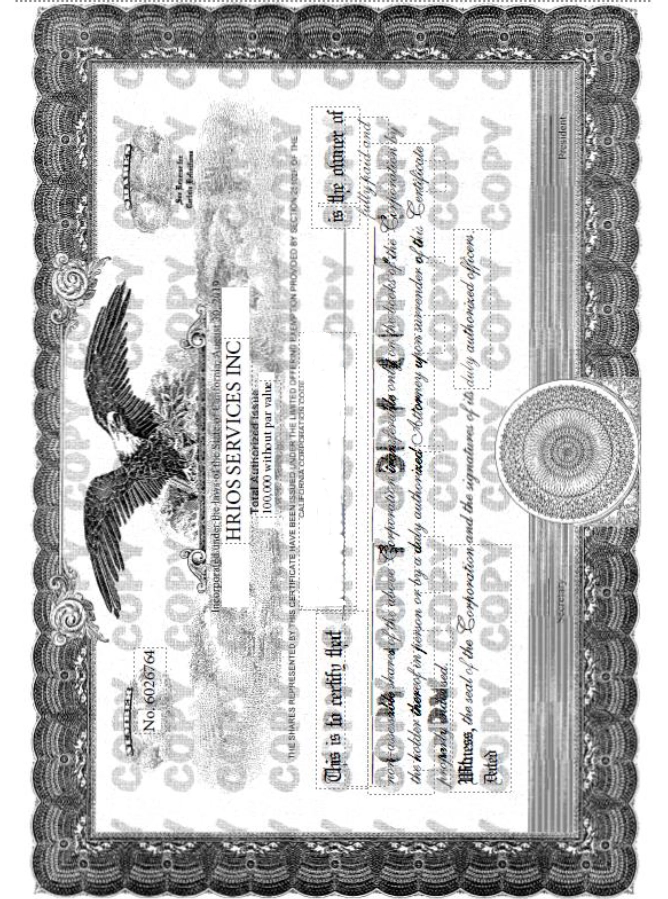

This is a standard template of the document used to represent ownership of shares in the corporation.

It includes:

- The corporation’s name.

- The shareholder’s name.

- The number of shares issued.

- An authorized officer’s signature.

Issued by the IRS, this is the corporation’s tax identification number.

It is used for:

- Filing federal taxes.

- Opening bank accounts.

- Hiring employees.

- Managing any financial interactions with the government.

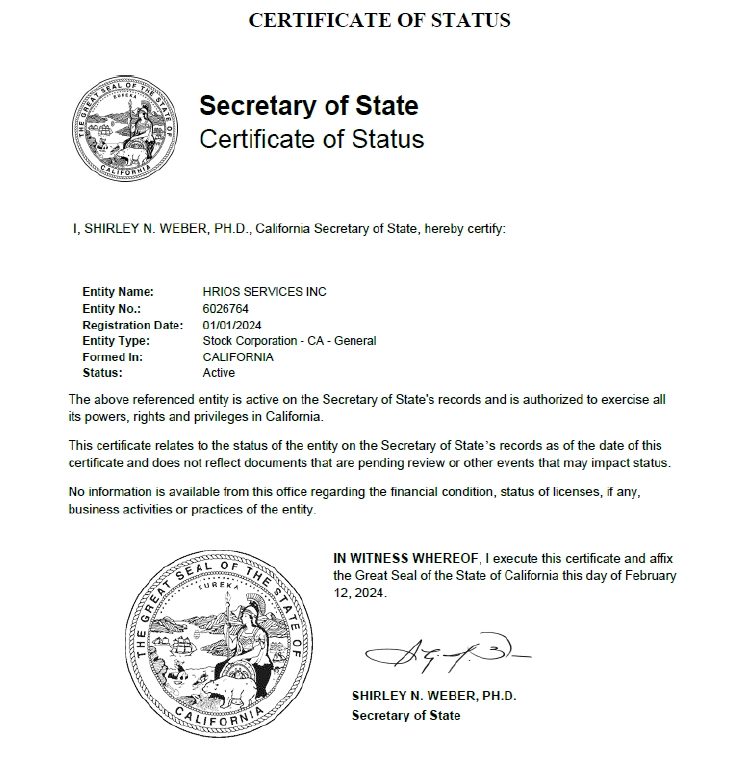

This document, issued by the state, certifies that the corporation:

- Is active and compliant with all state laws.

- Has filed the required reports and paid the necessary fees. Also known as a Certificate of Good Standing, it is required for certain transactions, such as opening bank accounts or expanding operations to other states.

After completing their initial duties (such as filing the Articles of Incorporation and appointing the initial directors), the incorporator can formally resign with this document.

It declares that:

- They no longer have obligations related to the corporation.

- They have transferred all authority to the directors or shareholders.

This report identifies the real owners of the corporation, complying with federal or state requirements to combat money laundering and terrorism financing.

It includes:

- Name, address, and personal details of individuals with a significant interest (usually more than 25% of shares).

- Details of those who control the corporation.

Printed Materials

Responsive Design